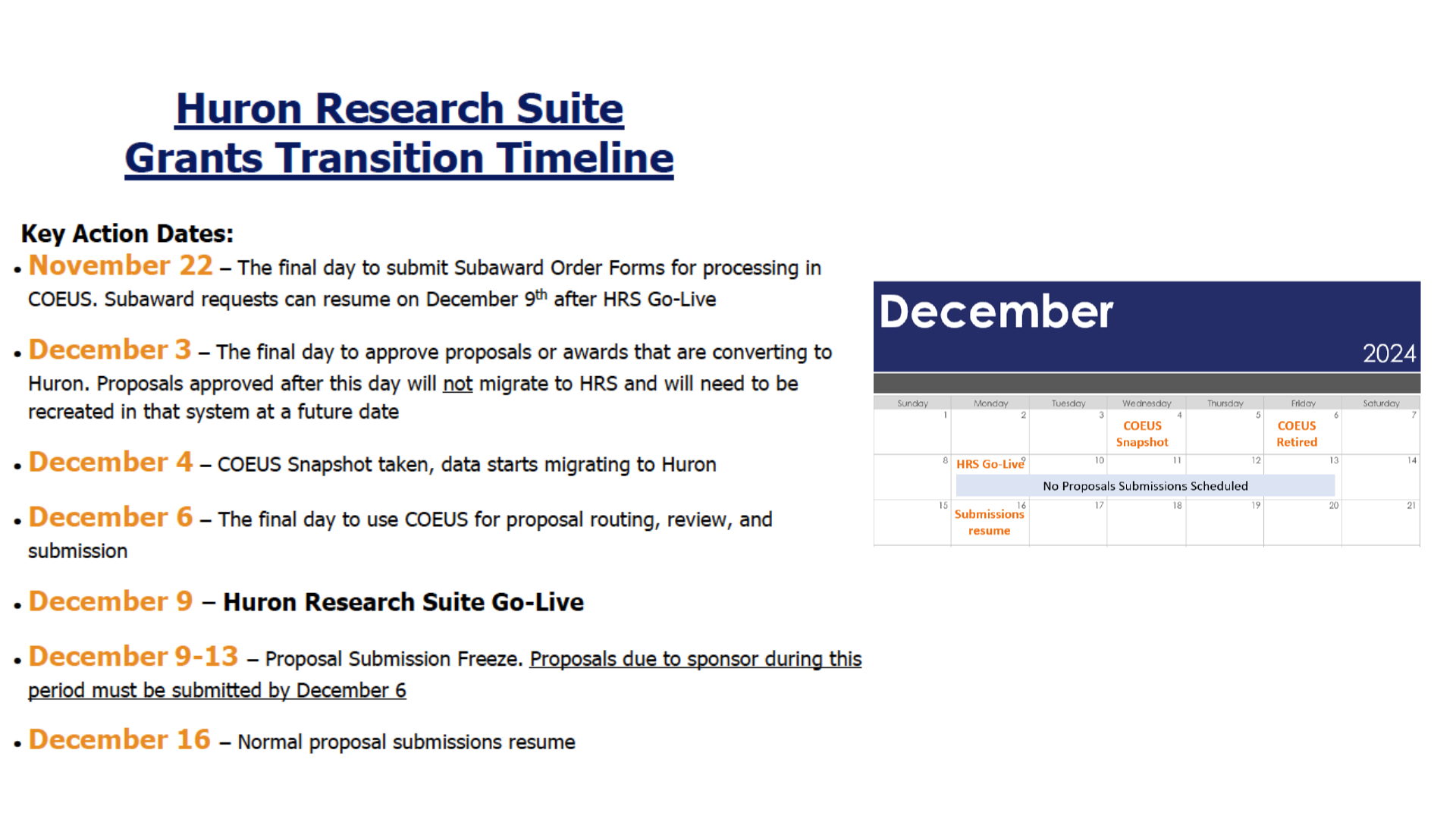

Important: Grants Transition Timeline

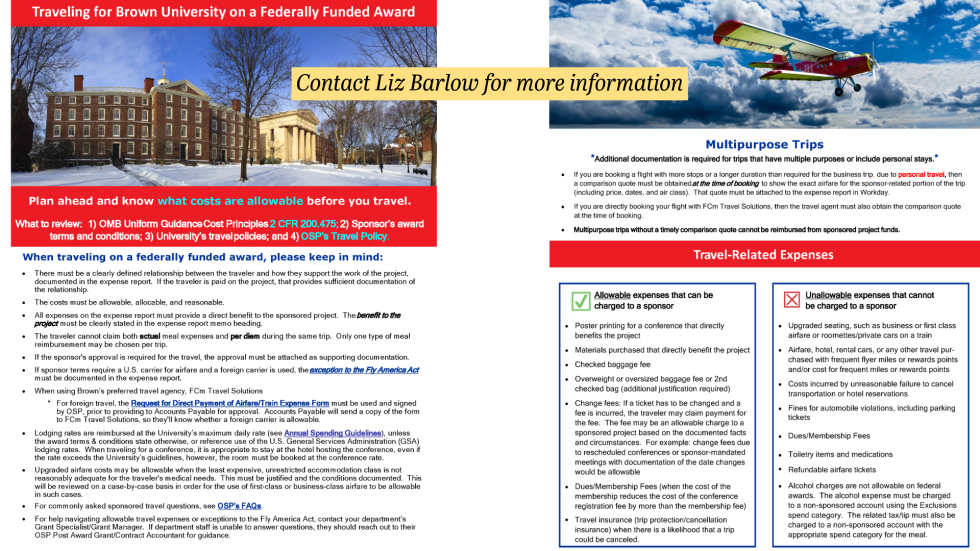

When traveling on a federally funded award, please keep in mind:

- There must be a clearly defined relationship between the traveler and how they support the work of the project, documented in the expense report. If the traveler is paid on the project, that provides sufficient documentation of the relationship.

- The costs must be allowable, allocable, and reasonable.

- All expenses on the expense report must provide a direct benefit to the sponsored project. The benefit to the project must be clearly stated in the expense report memo heading.

- The traveler cannot claim both actual meal expenses and per diem during the same trip. Only one type of meal reimbursement may be chosen per trip.

- If the sponsor's approval is required for the travel, the approval must be attached as supporting documentation.

If sponsor terms require a U.S. carrier for airfare and a foreign carrier is used, the exception to the Fly America Act

must be documented in the expense report.

- When using Brown’s preferred travel agency, FCm Travel Solutions

* For foreign travel, the Request for Direct Payment of Airfare/Train Expense Form must be used and signed by OSP, prior to providing to Accounts Payable for approval. Accounts Payable will send a copy of the form to FCm Travel Solutions, so they'll know whether a foreign carrier is allowable.

- Lodging rates are reimbursed at the University’s maximum daily rate (see Annual Spending Guidelines), unless the award terms & conditions state otherwise, or reference use of the U.S. General Services Administration (GSA) lodging rates. When traveling for a conference, it is appropriate to stay at the hotel hosting the conference, even if the rate exceeds the University’s guidelines, however, the room must be booked at the conference rate.

- Upgraded airfare costs may be allowable when the least expensive, unrestricted accommodation class is not reasonably adequate for the traveler's medical needs. This must be justified and the conditions documented. This will be reviewed on a case-by-case basis in order for the use of first-class or business-class airfare to be allowable in such cases.

- For commonly asked sponsored travel questions, see OSP’s FAQs.

- For help navigating allowable travel expenses or exceptions to the Fly America Act, contact your department’s Grant Specialist/Grant Manager. If department staff is unable to answer questions, they should reach out to their OSP Post Award Grant/Contract Accountant for guidance.

Multipurpose Trips

*Additional documentation is required for trips that have multiple purposes or include personal stays.*

- If you are booking a flight with more stops or a longer duration than required for the business trip, due to personal travel, then a comparison quote must be obtained at the time of booking to show the exact airfare for the sponsor-related portion of the trip (including price, dates, and air class). That quote must be attached to the expense report in Workday.

- If you are directly booking your flight with FCm Travel Solutions, then the travel agent must also obtain the comparison quote at the time of booking.

- Multipurpose trips without a timely comparison quote cannot be reimbursed from sponsored project funds.

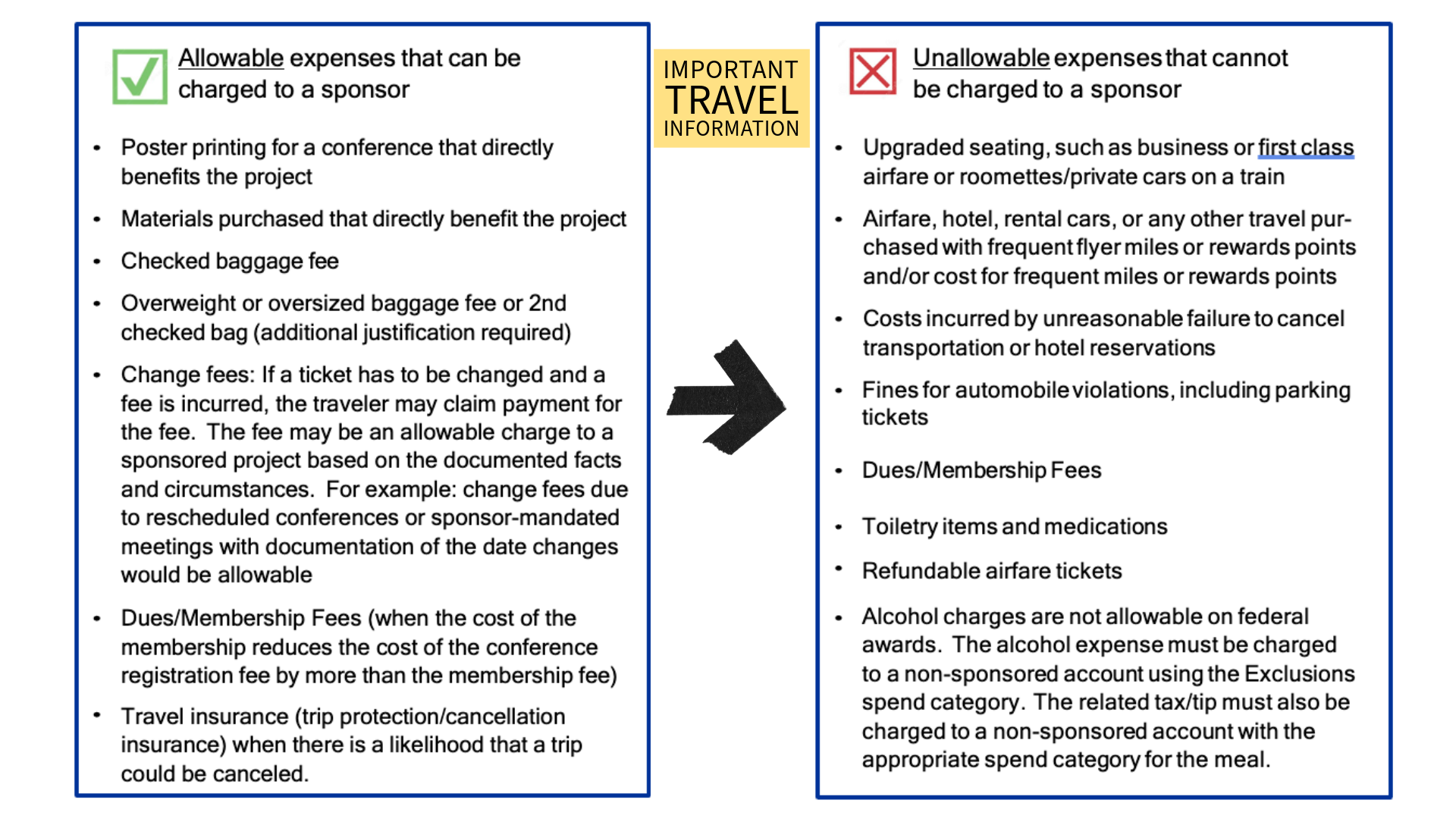

Travel‐Related Expenses